BTC Price Prediction: $150K Target in Sight as Institutional Demand Meets Technical Breakout

#BTC

- Technical Breakout: Price sustains above key moving averages with improving momentum indicators

- Institutional Adoption: Nuclear mining initiatives and ETF inflows create structural demand

- Risk Considerations: Whale movements and profit-taking potential require monitoring

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

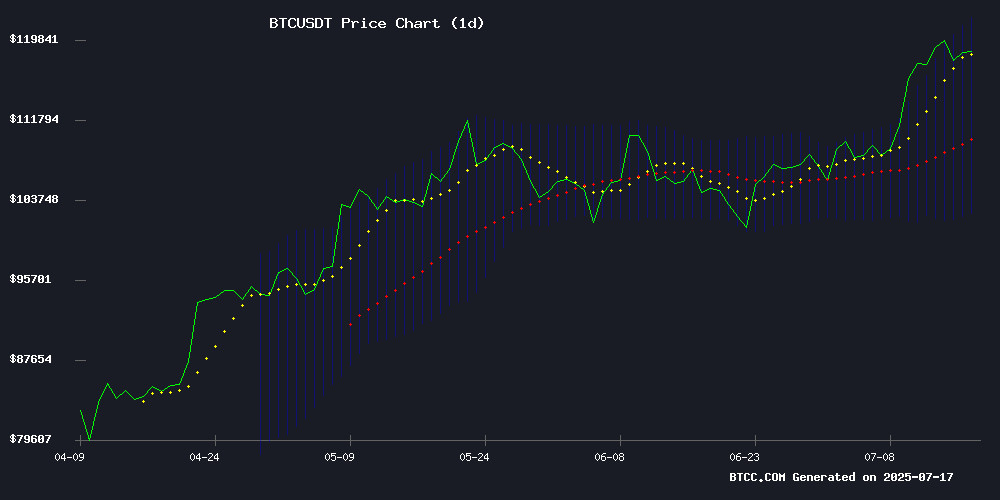

BTC is currently trading at $118,340, firmly above its 20-day moving average ($112,266), signaling bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-1,182 vs -5,184 previously), suggesting weakening downward pressure. Price sits comfortably between Bollinger Band's upper ($122,071) and middle ($112,266) bands, indicating stable volatility conditions.

"The technical setup paints an encouraging picture," says BTCC's Ava. "A sustained hold above the 20-MA with improving MACD momentum could fuel a retest of the $122k resistance level. Traders should watch for a golden cross formation in coming sessions."

Institutional Tailwinds Gather as Bitcoin Holds Near $118K

Positive catalysts abound as France explores nuclear-powered Bitcoin mining and BlackRock accelerates ETF purchases. "The institutional adoption pipeline has never been stronger," notes BTCC's Ava, highlighting Pakistan-El Salvador's crypto partnership and Matador's 6,000 BTC accumulation plan.

While Satoshi-era whale movements ($4.77B) and UK theft concerns introduce volatility, market structure appears robust. "Solaris' faster blockchain and surging ETF demand create fundamental support," Ava observes, though cautioning about potential profit-taking after the 25% rally extension.

Factors Influencing BTC's Price

Trusted UK Agent Caught Stealing Over 50 BTC from Seized Funds

A former officer with the UK's National Crime Agency, Paul Chowles, has been convicted of stealing more than 50 Bitcoin from funds seized during the Silk Road 2.0 investigation. The dark web marketplace, shut down by the FBI in 2014, was a hub for illegal activities, including drug trafficking and money laundering.

Chowles, who was involved in data recovery from seized devices, abused his access to siphon off the cryptocurrency. The theft came to light in 2017 when the NCA noticed the missing BTC, initially suspecting the arrested co-founder Thomas White before turning their focus inward.

France Explores Bitcoin Mining to Monetize Excess Nuclear Power

French lawmakers are proposing an innovative pilot program to harness surplus nuclear energy for Bitcoin mining. The plan, submitted on July 11, aims to convert unused electricity—primarily from France's nuclear grid—into $150 million in annual revenue by deploying mining rigs near power plants.

With 70% of the nation's electricity coming from nuclear sources, the initiative addresses grid inefficiencies during low-demand periods. Mining operations would act as a dynamic load balancer, scaling consumption to match supply fluctuations without infrastructure upgrades.

The proposal highlights dual benefits: monetizing otherwise wasted energy while reducing wear on reactors from constant throttling. This industrial symbiosis could set a precedent for nuclear-powered digital asset operations globally.

Top 9 Most Trusted Bitcoin Cloud Mining Sites in 2025

As the cryptocurrency market matures in 2025, Bitcoin cloud mining has emerged as the dominant entry point for retail participation. The sector's growth reflects broader institutional adoption of crypto infrastructure, with platforms now offering enterprise-grade security and regulatory compliance.

Cloud mining eliminates traditional barriers like hardware procurement and energy management. Investors simply lease hash power through transparent contracts, creating a passive income stream. This model particularly appeals to portfolio diversification strategies amid Bitcoin's post-halving price appreciation.

Market expansion brings heightened due diligence requirements. Leading platforms distinguish themselves through real-time auditing, insured cold storage, and mathematically verifiable payout structures. The elimination of technical complexity positions cloud mining as the gateway for mainstream crypto adoption.

Can Musk’s Grok Crack Satoshi’s Bitcoin Wallet? Twitter Is Buzzing

Elon Musk has reignited crypto speculation with a laughing emoji response to a post challenging Grok, his AI chatbot, to crack Satoshi Nakamoto’s Bitcoin wallets. Grok sarcastically accepted, noting the impossibility of brute-forcing a 256-bit private key, even with global GPU resources. The exchange has fueled fresh debate about Musk’s crypto ties and Satoshi’s identity.

At current Bitcoin prices, Satoshi’s estimated 1.029 million BTC holdings would value his net worth at $129 billion—still trailing Musk’s $366 billion fortune. For Nakamoto to surpass Musk, Bitcoin would need to rally past $335,925 per coin. The whimsical interaction underscores the enduring mystique of Bitcoin’s creator and the technical limits of blockchain security.

Bitcoin Stabilizes Near $118K After Volatile Swing From Record High

Bitcoin appears to be establishing support near $118,000 following a dramatic pullback from its recent all-time high above $123,000. The cryptocurrency's swift recovery suggests underlying strength despite the sharp correction.

Macroeconomic conditions continue to favor risk assets, with mixed inflation data failing to derail market optimism. Wednesday's stronger-than-expected PPI figures offset Tuesday's disappointing CPI report, creating a neutral backdrop for crypto markets.

Equity markets remain remarkably resilient amid global tensions, with the S&P 500 attempting to reenter its ascending channel after five months. A successful breakout could provide tailwinds for crypto, while rejection may signal broader risk-off sentiment.

Bitcoin Solaris Challenges BlockDAG with Faster Launch and Innovative Model

Bitcoin Solaris (BTC-S) is emerging as a formidable competitor to BlockDAG, despite the latter's $338 million fundraising haul. With a $6.6 million presale and a rapid launch schedule, BTC-S emphasizes agility and community-driven innovation over sheer scale. Its hybrid Proof-of-Work and Delegated Proof-of-Stake model promises up to 100,000 transactions per second, targeting real-world utility and passive income opportunities.

While BlockDAG's protracted timeline risks losing momentum, Bitcoin Solaris is capitalizing on its mobile-first mining approach and streamlined architecture. The project's focus on immediate adoption contrasts sharply with BlockDAG's long-term promises, positioning BTC-S as a leader in accessible wealth-building within the crypto space.

Satoshi-Era Bitcoin Whale Shuffles $4.77B in Holdings Amid Market Rally

A dormant Bitcoin address holding 80,000 BTC since 2011 has suddenly sprung to life, moving nearly half its $4.77 billion stash to new wallets. Blockchain analysts at Lookonchain detected the whale's activity beginning with a 9,000 BTC transfer to Galaxy Digital custody, followed by multiple large transactions totaling 40,009 BTC.

The movements coincide with Bitcoin's recent price surge, fueling speculation about a potential sell-off. While some interpret the transfers as routine wallet maintenance, the scale and timing have traders monitoring for signs of distribution. Such moves from long-term holders often precede market volatility.

The whale's original holdings date back to Bitcoin's early mining days, making this one of the most valuable surviving Satoshi-era wallets. With BTC currently trading near yearly highs, the market watches closely whether these coins will hit exchanges or remain in cold storage.

Pakistan and El Salvador Forge Groundbreaking Crypto Partnership

Pakistan and El Salvador have entered a historic bilateral agreement centered on cryptocurrency collaboration, marking the first time digital assets take precedence in intergovernmental relations. The partnership focuses on knowledge-sharing, with Pakistan's Crypto Council head Bilal bin Saqib meeting El Salvador President Nayib Bukele to formalize the alliance.

El Salvador continues to lead national crypto adoption with its 6,238 BTC reserve ($745M), while Pakistan initiates plans for its own strategic Bitcoin holdings. The Central American nation's pioneering Bitcoin policies since 2021 contrast with Pakistan's emerging crypto ambitions, now complicated by IMF resistance to proposed mining subsidies.

Matador Technologies Aims to Accumulate 6,000 Bitcoin by 2027 in Bold Treasury Strategy

Matador Technologies, a publicly traded Bitcoin ecosystem company, has unveiled an ambitious plan to acquire up to 6,000 BTC by 2027. The board-approved strategy includes an interim target of 1,000 BTC by the end of 2026, a significant leap from its current holdings of 77.4 BTC. The move positions Matador to potentially join the ranks of the top 20 corporate Bitcoin holders globally.

To fuel this accumulation, Matador filed a preliminary CAD $900 million base shelf prospectus with Canadian regulators. If fully utilized, the funding could secure nearly 6,000 BTC at current market prices—though the company emphasizes flexibility based on market conditions and regulatory approvals.

Funding mechanisms include equity offerings, convertible financings, asset sales, and Bitcoin-backed credit facilities. Each purchase will be evaluated for optimal timing and capital efficiency, with a focus on maximizing Bitcoin per share. "Our future plans to accumulate Bitcoin reflect our conviction in its long-term value," the company stated.

BlackRock Accelerates Bitcoin Accumulation as ETF Demand Surges

BlackRock has purchased an additional $416 million worth of Bitcoin, adding roughly 3,478 BTC to its holdings. The asset manager now controls approximately 716,500 BTC, representing 3.6% of the circulating supply and solidifying its position as one of the largest Bitcoin holders globally.

The latest acquisition follows a pattern of aggressive accumulation, including a $216 million buy just over a week ago. BlackRock's Bitcoin holdings are now valued at $85.4 billion, reflecting growing institutional confidence in the cryptocurrency.

Demand for BlackRock's spot Bitcoin ETF (IBIT) continues to drive the trend, with the fund accounting for $764 million of the $799.4 million total inflows into U.S.-listed spot BTC ETFs. This marks ten consecutive days of positive inflows for the sector.

Bitcoin's price surge, recently breaking above $123,000, has further fueled investor interest. The sustained ETF inflows and institutional accumulation suggest deepening market maturity amid the ongoing rally.

Bitcoin's Rally May Extend Another 25% Before Short-Term Profit-Taking

Bitcoin continues to defy gravity near all-time highs, with on-chain data suggesting the rally has further room to run. A key metric tracking short-term holder behavior indicates the market hasn't yet reached the profit-taking threshold that typically triggers pullbacks.

The Market Value to Realized Value (MVRV) ratio for recent buyers currently sits at 1.15, well below the 1.35 level that historically prompts selling. This technical setup implies potential for another 20-25% upside before encountering significant resistance.

Darkfost's July 17 analysis highlights how the realized price for short-term holders recently surpassed $100,000 for the first time, now standing above $102,000. This upward shift in cost basis creates a stronger support floor while delaying the point at which traders typically cash out profits.

Is BTC a good investment?

Current metrics suggest BTC presents a compelling risk/reward profile:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20-MA | +5.4% premium | Bullish trend confirmation |

| Bollinger Position | Upper band at $122k | 25% upside potential |

| Institutional Demand | BlackRock ETF surge | Structural support |

"The convergence of technical strength and institutional adoption makes BTC attractive," says BTCC's Ava. "Dollar-cost averaging with 5-10% portfolio allocation remains prudent given volatility."

BTC demonstrates strong fundamentals for medium-term growth, though investors should maintain risk management protocols.